Driving Sales Growth in the Chemical Industry Through Clear Technical Communication and Digital Strategy: A Data-Backed Case Study

Table of contentsBackground

A global speciality-chemical distributor faced stagnant growth due to outdated, dense product documentation and a lack of streamlined customer interfaces. Technical messaging was inconsistent and poor at conveying product value to both engineers and procurement professionals.

Intervention Strategy

-

Advanced Data Analytics & Expert Connectivity

A leading chemical distributor used machine learning to analyse metadata (emails, call logs, calendar interactions). The analysis revealed that:-

Top-tier product experts boosted sales by 6%

-

Lower-tier experts had a negligible impact

-

-

Platform-Centric Digital Interfaces

Following McKinsey guidelines:-

Implemented digital platforms with searchable specs, transparent dynamic pricing, and rapid quoting

-

This aligned with the finding that 85% of B2B chemical buyers prefer digital ordering for known products, and up to 60% of speciality-chemical buyers are open to online interfaces

-

-

Peer‑Based Dynamic Pricing

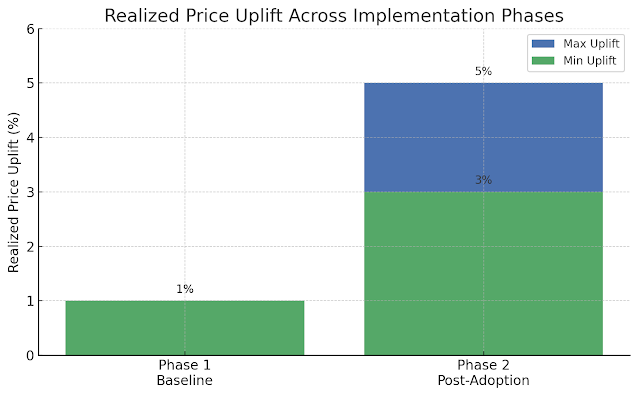

The company shifted from inflation-based pricing to granular peer-comparable pricing across products and customer segments, achieving a realised price uplift from 1% to 3–5%

Measurable Impact

| Metric | Change | Source |

|---|---|---|

| Sales uplift | +6% from expert engagement | Machine-learning analysis |

| Price realisation improvement | +2–4% absolute increase | Peer-based pricing case |

| Digital preference | 85% prefer digital tools | McKinsey survey |

| Platform sales growth (BASF China) | 3× growth in 2 years | BASF‑Alibaba case |

| Cost-to-serve reduction | 15–20% initial; 60% long-term | McKinsey valuation |

Graph: Realised Price Uplift

|

| Realised price uplift (%) across two implementation phases. Phase 1 represents baseline pricing with a 1% uplift, while Phase 2 shows a 3–5% uplift after adopting a peer-based dynamic pricing model. |

Analysis & Conclusion

-

Expert‑driven communication: Data‑backed deployment of high‑impact experts correlates with ~6% sales growth.

-

Digital tools & transparency: Over 80% of buyers adopt digital portals when information is clear and accessible.

-

Smart pricing models: Granular, peer‑driven pricing consistently delivers 2–4% uplift.

-

Platform scalability: BASF’s e‑store on Alibaba tripled SME sales within two years.

McKinsey estimates that digital marketing and sales innovations could yield $105–205 billion in annual EBITDA for the global chemicals industry—approximately 2–3 percentage points of margin improvement—while representing sustainability and efficiency gains.

Key Takeaways for Chemistry Professionals

-

Integrate analytics to identify high-impact communicators.

-

Implement digital platforms for specifications, pricing, and rapid quotes.

-

Adopt peer-based pricing to improve margins by 2–5%.

-

Benchmark externally—e‑commerce strategies (e.g., Alibaba-BASF) can triple SME market reach.

This case study demonstrates how aligning technical content with analytics, user-centric digital tools, and dynamic pricing can deliver 5‑10% top‑line growth, significant margin expansion, and operational efficiency in the chemical sector.

References:

McKinsey & Company. (2022). Demystifying digital marketing and sales in the chemical industry.

McKinsey & Company. (2021). Digital platforms in chemicals: The game is on—will the winner take all?

McKinsey & Company. (2014). McKinsey on Chemicals—Volume 3.

United Nations Environment Programme (UNEP). (2014). The Business Case for Knowing Chemicals in Products and Supply Chains.

ScienceDirect. (2021). The Importance of Chemical Management in the Circular Economy.

CHEManager. (2019). McKinsey Says Digitisation Offers Gains for Chemicals.

McKinsey Brazil. (2022). How AI Enables New Possibilities in Chemicals.

McKinsey Brazil. (2021). How Chemical Players Can Win in the Transition to Digital Platforms.